Decentralized exchanges, commonly known as DEXs, have significantly transformed the landscape of cryptocurrency trading. These platforms empower users to exchange digital assets securely and transparently, eliminating the need for intermediaries or central authorities.

In stark contrast to traditional centralized exchanges, which often rely on revenue streams such as trading fees, DEXs operate on a distinct model for generating income. Now, let’s delve into the fascinating realm of how much money do crypto exchanges make.

What is a Centralized Exchange?

The usual way people trade cryptocurrencies is through centralized exchanges (CEXs). These exchanges act like middlemen, keeping your money secure and making trades on your behalf.

But, there’s a catch when you use a CEX. You usually have to go through some checks called Know Your Customer (KYC) and Anti-Money Laundering (AML). It can be a bit slow, and they ask for your info. Now, let’s switch gears and talk about how do decentralized exchanges make money in this mix.

Must Read: How to Start a Cryptocurrency Trading Business.

What is Decentralized Exchange?

Unlike the usual way of doing things, decentralized exchanges (DEXs) let users trade cryptocurrencies without involving a middleman. DEXs get rid of the need for someone else to handle your money or manage trades by using smart contracts on blockchain networks. Smart contracts are like computer rules that follow through automatically when certain conditions are met. They’re the tech behind making financial deals happen on decentralized exchanges (DEXs) using blockchain.

DEXs are often less controlled than regular exchanges and come with cool stuff like atomic swaps and trustless transactions. Now, let’s dive into the realm of how much money do crypto exchanges make.

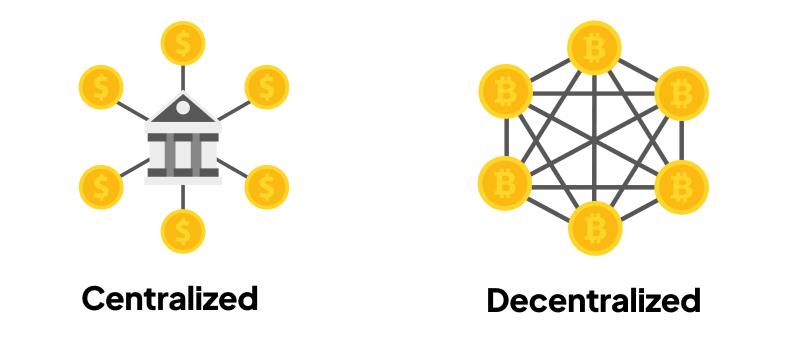

Difference Between Centralized and Decentralized.

Regular exchanges such as Coinbase and Binance, known as centralized exchanges (CEX), are easy for users and have lots of different assets. But, they have control over your money and need your personal info. On the flip side, decentralized exchange (DEX) platforms let people trade directly with each other without holding onto their money or needing personal details. So, let’s explore how decentralized exchanges make money in this scenario.

Uses of Decentralized exchanges.

Decentralized exchanges (DEXs) offer a bunch of cool advantages compared to regular ones. If you want to jump into the DEX game, here’s a simple guide:

1. Pick a DEX: There are loads out there, so find one that fits your style. Check out fees, security, and what kind of assets they support.

2. Connect Your Wallet: Most DEXs need you to link up your wallet to start trading. Just plug in your wallet address on the exchange.

3. Start Trading: Once your wallet is hooked up, dive into trading. Get comfy with the platform’s tools before you go all in.

4. Watch Your Money: Keep an eye on your funds to make sure they’re safe. Regularly check for anything fishy or transactions you didn’t okay. Easy peasy!

Most Popular DEXs In 2024

Before you dive into any decentralized exchange, it’s crucial to know which ones are trustworthy and popular. You’ve got quite a few options, like Uniswap, Curve, and Balancer.

Now, here’s a cool trick consider using a DEX aggregator. It’s like a one-stop shop that grabs the best rates from different places, all in one easy-to-use interface.

Now, you might be wondering, How much can I make trading crypto?

Well, that’s the golden question. It depends on which DEX you pick, market conditions, and some luck. Unpack the features and perks of different DEXs to find the one that fits your style. Happy trading!

Conclusion

In the ever-evolving landscape of cryptocurrency trading, decentralized exchanges (DEXs) have emerged as game-changers, reshaping how users engage with digital assets. Unlike their centralized counterparts, DEXs operate on a peer-to-peer model, leveraging smart contracts on blockchain networks to facilitate secure and transparent transactions without the need for intermediaries.

So, how do decentralized exchanges make money in 2024? Unlike traditional trading fees associated with centralized exchanges, DEXs generate income through innovative mechanisms. Liquidity provision, token listings, and governance token participation are some avenues where DEXs carve out their revenue streams. By empowering users to directly trade with one another, DEXs eliminate the need for personal information and cumbersome KYC/AML checks, providing a faster and more private trading experience.

Choosing a DEX involves considering factors like fees, security, and support assets. In 2024, popular DEXs like Uniswap, Curve, and Balancer offer diverse options for traders. To optimize your trading experience, utilizing a DEX aggregator can simplify the process by providing the best rates from various platforms in a single interface.

As for the golden question, how much can I make trading crypto? The answer lies in the unique features and market conditions of the chosen DEX, coupled with a touch of luck. Exploring the perks of different DEXs is key to finding the one that aligns with your trading style. Whether you’re a seasoned trader or a newcomer, navigating the decentralized exchange realm offers a multitude of opportunities for those seeking financial autonomy. Happy trading!